Join more than 10,000 merchants and 150,000+ borrowers who have trusted LendingUSA over the years.

2000+5-Star Reviews

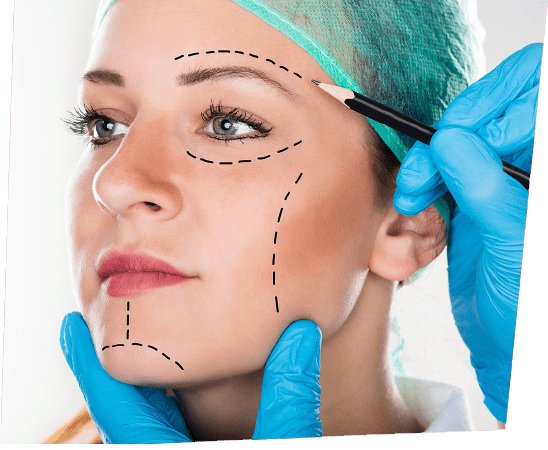

Benefits of plastic surgery financing

with LendingUSA

Grow Your Business

With more ways to pay, your cosmetic surgery patients can afford the care they need, allowing you to grow your business while offering the best services for your plastic surgery patients.

Get Paid Faster

Receive your payment upfront and faster with direct funding to your business within a few days—we assume the risk of default.

Pre-Approvals in Seconds

With a 24/7 online interface, your clients can apply online anytime and receive a pre-approval decision within seconds.

How LendingUSA Works

Enroll

There's no cost to get started. Sign up today and get access to your online financing portal, along with one-on-one onboarding and training with your dedicated account manager.

Finance

With LendingUSA, you have the power to offer financing to any of your clients with a process that takes only a few minutes.

Grow

Because we fund your business directly in a matter of days, you can turn your attention toward attracting new customers that may have not been willing or able to pay for services without a financing option.

MORE INFORMATION

We make it easy to grow your cosmetic practice

Exclusive patient financing partner of the American Academy of Cosmetic Surgery (AACS)

Introduction

Our seamless, paperless process works with any mobile, tablet, or computer, can be completed right in your office, and funds your practice quickly and directly. You’ll also have free technical and marketing support, plus a dedicated Relationship Manager always on hand to provide expert guidance and help you reach your business goals. It’s everything you need to help grow your cosmetic practice.

Do cosmetic practices offer financing?

Yes, many cosmetic practices offer third-party financing through LendingUSA. Cosmetic surgeries and other services can add up quickly in cost, and many everyday people may not be able the total up front for these expenses. By offering financing as an option to your patients, you can communicate that you value their comfortability when it comes to payment, setting yourself apart from the competition.

How can I offer financing at my cosmetic practice?

Although the process of offering financing can feel overwhelming, LendingUSA makes it easy and stress-free. It’s free to enroll, and once you do, you can offer financing to every patient who comes through your door. Your practice is funded within just a few days of your patient signing their loan agreement, and the patient repays the loan in manageable, monthly installments.

How can I qualify patients for a cosmetic loan?

Qualifying your patients for cosmetic financing is fairly straightforward. Your employees don’t need to undergo intensive financial training; however, it is important that they know the basic features of the loan so that they can answer any questions that potential patients may have. In terms of credit approval, while a better credit history may keep interest fees lower, poor credit is not an automatic disqualification for a cosmetic loan. When a patient has shown interest in financing, they must fill out an application through the LendingUSA merchant or online portal. If they are pre-approved, they may receive multiple loan offers. They can select the loan that works best for them.

Can patients finance surgery if their credit isn’t good?

Cosmetic surgery financing with bad credit is possible. With LendingUSA, good and bad credit borrowers can qualify for plastic surgery financing. While they may not qualify for the lowest rate or highest loan amount, they can still get a loan for the cosmetic surgery needs. If they’re worried about being able to afford the monthly payments, they may want to borrow a lower amount. It’s also important to remind your patients that when they first apply and acquire a loan for cosmetic surgery, their credit score might drop. This credit score decrease is temporary, however, and with on-time payments, it’s likely their score will increase over time.

Cosmetic surgeons can save thousands with LendingUSA

Related Industries We Serve

We provide point-of-sale financing for a verity of niche industries:

More insights from our blog

Check out our blog for more resources on how businesses can navigate point-of-sale financing, provide an excellent customer experience, and more industry insights.