Unlike credit cards, we offer fixed payment amounts with fixed terms for weight loss surgery financing. This gives you greater flexibility and control over what you pay per month. It also allows you to pay no interest on principal if paid in full within the first six months of your disbursement date*.

What makes us better than using a credit card?

Application Time

In Minutes

Pre-Approval Decision

In Seconds

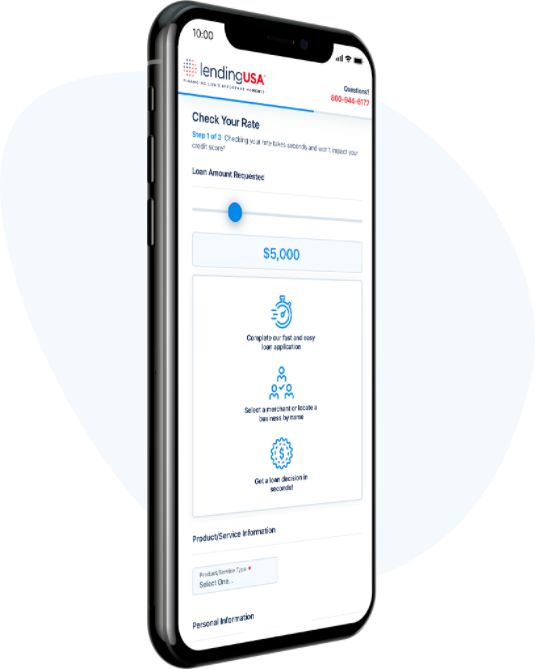

You can apply online, from anywhere. Simply provide the required information, choose your term and monthly payment, and then sign the online agreement. It’s all fast, easy, and secure.

Benefits of A LendingUSA Weight Loss Surgery Financing

Increased

Buying Power

With high loan amounts, you won’t need to settle for services you don’t want.

Affordable

Monthly Payments

Select a monthly payment amount that fits comfortably into your household budget.

No

Interest Promotion

Pay $0 in interest when you pay off your loan in full within 6 months*.

MORE INFORMATION

Weight Loss Surgery Financing: Loans for Bariatric Surgery

Is there such a thing as guaranteed financing for weight loss surgery? While some lenders may increase your chance of approval, most lenders do not offer guaranteed financing. Being severely overweight can have a negative impact on your overall health and your overall quality of life. You may suffer from mobility issues that prevent you from doing the activities that you have long enjoyed or mobility issues that prevent you from spending quality time with your friends and family.

Not only are mobility issues a concern, but obesity can have a major strain on your heart and damage your blood vessels, increasing your risk of heart attack, stroke, kidney disease, and death. Obesity can lead to diabetes, sleep apnea, fatty liver disease, osteoarthritis, gallbladder disease, and even some cancers.

If you have tried dieting and exercising, but still are finding it difficult to lose weight and keep it off, you may want to consider a weight loss surgery to help you lose the weight you need to get your life back. If you are worried about the cost of weight loss surgery because either your insurance does not cover the procedure or because you do not have insurance, then you should be looking for weight loss surgery financing. LendingUSA can provide financing for weight loss surgery and other medical procedures.

By securing weight loss surgery financing, you will not only get your life back, but you could potentially save yourself thousands of dollars in medical costs that your future may hold if you do not act now to get your weight down and under control.

https://www.niddk.nih.gov/health-information/weight-management/adult-overweight-obesity/health-risks

Can weight loss surgery be financed?

Yes, of course, you can finance weight loss surgery. To find out if you qualify for weight loss surgery financing, you can apply at LendingUSA. At LendingUSA you can qualify for up to $12,000 to fund your gastric bypass, sleeve, band, any other weight-loss surgical procedure. Prequalifying is easy on the LendingUSA website. Within a few minutes, you can find out how much you could qualify for and at what interest rates.

First, simply go to the LendingUSA website and enter in some personal information as well as some financial and employment information. Once all the fields have been filled and the information has been submitted, a “soft pull” credit check will be conducted to see if you qualify and at what interest rates. A soft pull credit check has no impact on your credit score whatsoever.

Once you are preapproved, you can then view all the terms and conditions of the weight loss surgery financing. If you can afford the payments, you can move forward with securing financing. If you accept the loan offer, a hard credit pull will probably need to be done to finalize your approval. As a result, you may see your credit score drop some, but over time with on-time payments your credit should recover. In some cases, a medical loan can even improve your credit score. After approving a hard credit pull and submitting any additional information, you can receive funds in as little as one business day, although funding times can vary.

Can you get weight loss surgery without insurance?

If you do not have health insurance, you can still get weight loss surgery to help improve your health and your overall quality of life. One of the most common ways to acquire the funds to get weight loss surgery is through a personal loan, also known as a medical loan. A medical loan can allow you to pay for all or most of your upfront surgery costs and then pay for it over time by making monthly payments. Some lenders, such as LendingUSA, even offer 0% APR options for those who can pay for the entire loan amount within 6-months of the loan disbursement date. For some, it may not be feasible to repay the entire loan in just 6-months but a medical loan can still save hundreds or even thousands of dollars compared to using a credit card for financing.

Even if you have insurance, some insurance companies will not cover the costs of weight loss surgery. Again, by using a medical loan, you can bypass your insurance company and pay off the cost of your surgery with monthly payments. You and the lender will agree upon the interest rate and the length of the loan repayment period. Those two factors, along with the loan amount, can determine what kind of monthly payments you will need to make and for how long. Make sure you choose a loan repayment period that provides you with monthly payments that you can afford. You will want to avoid additional fees and penalties that can occur if you start making late payments. Be sure you are financially prepared to take on the amount needed for the weight loss surgery in the form of a loan. Any late payments and/or default on the loan will have a lasting negative impact on your credit score.

What weight loss surgery has the best results?

Many studies and clinical trials have found gastric bypass surgery to be the most effective in terms of the greatest overall weight loss results. Though gastric bypass surgery can have the most dramatic results, it can also have the most complications. Therefore, anyone considering the procedure should consult with their physician and review the potential complications that may occur.

One study that was conducted by analyzing the results of 25,000 people who had gastric bypass surgery saw an average weight loss of 31% in the first year and an average weight loss of 25% over 5 years.

Compared to the other procedures that were performed in the same study, for example, the sleeve gastrectomy, and banding, gastric bypass had the best results.

https://www.webmd.com/diet/obesity/news/20181030/which-weight-loss-surgery-is-best#1

What are the pros and cons of gastric bypass surgery?

Gastric bypass surgery is not for everyone. You should talk to your doctor to make sure you are in well enough condition for an invasive surgery like gastric bypass surgery. Even if you get the green light from your doctor, there are other pros and cons you should consider before following through with the procedure.

Let us take a close look at what the pros and cons of gastric bypass surgery are:

Pros:

- Rapid weight loss due to the decreased capacity of food in your body..

- Reduction of excess body weight by an average of up to 75% in one year.

- Resolve Type 2 diabetes in 90% of individuals who have the procedure.

- An increase in overall health and quality of life.

Cons:

- Increased risk of small bowel obstruction, internal hernia, and ulcers.

- Can induce instant bathroom use with a rapid gastric emptying after food consumption.

- Other symptoms include abdominal cramps, confusion, diarrhea, mood changes, nausea, sweating, vomiting.

In addition to many of these symptoms that could occur, you will notice what foods will upset your stomach and result in these types of reactions. By avoiding foods that cause reactions, you can evolve your diet to only consist of foods that do not agitate your gastric system.

https://www.virtua.org/articles/weigh-the-pros-and-cons-of-gastric-bypass-surgery

How can I get weight loss surgery with bad credit?

Securing weight loss surgery with bad credit may be challenging, but not always impossible. At LendingUSA we strive to approve as many borrowers as we can. If you have bad credit you can still apply at LendingUSA to see if you qualify for financing. You can get pre-qualified at LendingUSA without impacting your credit score. As a result, you really have nothing to lose and everything to gain if you do qualify. With a bad credit score, you may have to pay high interest rates and other fees, which we usually discourage. However, when it comes to paying extra to ensure your health and well-being, it may be worth it. Before committing to a loan always make sure you can cover the monthly payment.

What credit score do you need to finance weight loss surgery?

Most lenders will have a minimum credit score requirement. If you have a low credit score, you may want to see if the lender can disclose the minimum credit score requirement before applying. Just because you meet a credit score requirement, does not mean you are guaranteed to qualify for a loan. Most lenders will consider other factors in addition to credit score. These factors can include debt-to-income ratio and annual income. At LendingUSA, we can approve patients with credit scores 620 or better. If your credit score is around 620 or better, you should go ahead and see if LendingUSA can provide the weight loss surgery financing that you need.

What procedures can you get with weight loss surgery financing?

Weight loss surgery financing covers gastric bypass surgery, gastric sleeve surgery, as well as gastric banding procedures. You can use weight loss surgery financing to cover just about any procedure recommended by your doctor.

What are the pros and cons of weight loss surgery financing?

There are plenty of pros and cons to seeking financing for your weight loss procedure. Pros like a rapid depositing of funds into your account and cons such as the possibility of late fees and penalties if you start to fall behind on your loan payments.

Here is a quick summary of the pros and cons of weight loss surgery financing:

Pros:

- The process to be pre-approved and to apply for the loan is quick and easy.

- Once the loan is approved, you could see funding in as little as 24-hours.

- You may lock in a much lower interest rate than your credit cards can offer.

Cons:

- Interest payments will need to be made in exchange for securing the funds upfront.

- Opening a new line of credit can impact your credit score and affect securing financing for other purposes.

Like everything else in life, there are always the pros and cons of any given situation. You must weigh those pros and cons and complete a cost-benefit analysis of your situation to determine if financing is the best option available to you.

Conclusion

Getting the weight loss surgery you need can help you enjoy a long and healthy life. Money should not hold you back from getting the medical treatment you need. At LendingUSA we are committed to helping patients get the financing they need to afford medical treatments such as weight loss surgery.

Get pre-qualified for weight loss surgery financing with no impact on your credit score!

Join more than 150,000 borrowers who trust LendingUSA

2000+5-Star Reviews

Checking your rate won’t harm your credit score†

You won’t be penalized for exploring your weight loss financing options, so there’s no reason to delay. Now is always the best time to finance life’s important moments.

Check Your RateOther Industries We Serve

We don't stop at pet financing. Learn how LendingUSA can help you navigate all of life's important moments.

More insights from our blog

Check out our blog for more resources on how businesses can navigate point-of-sale financing, provide an excellent customer experience, and more industry insights.